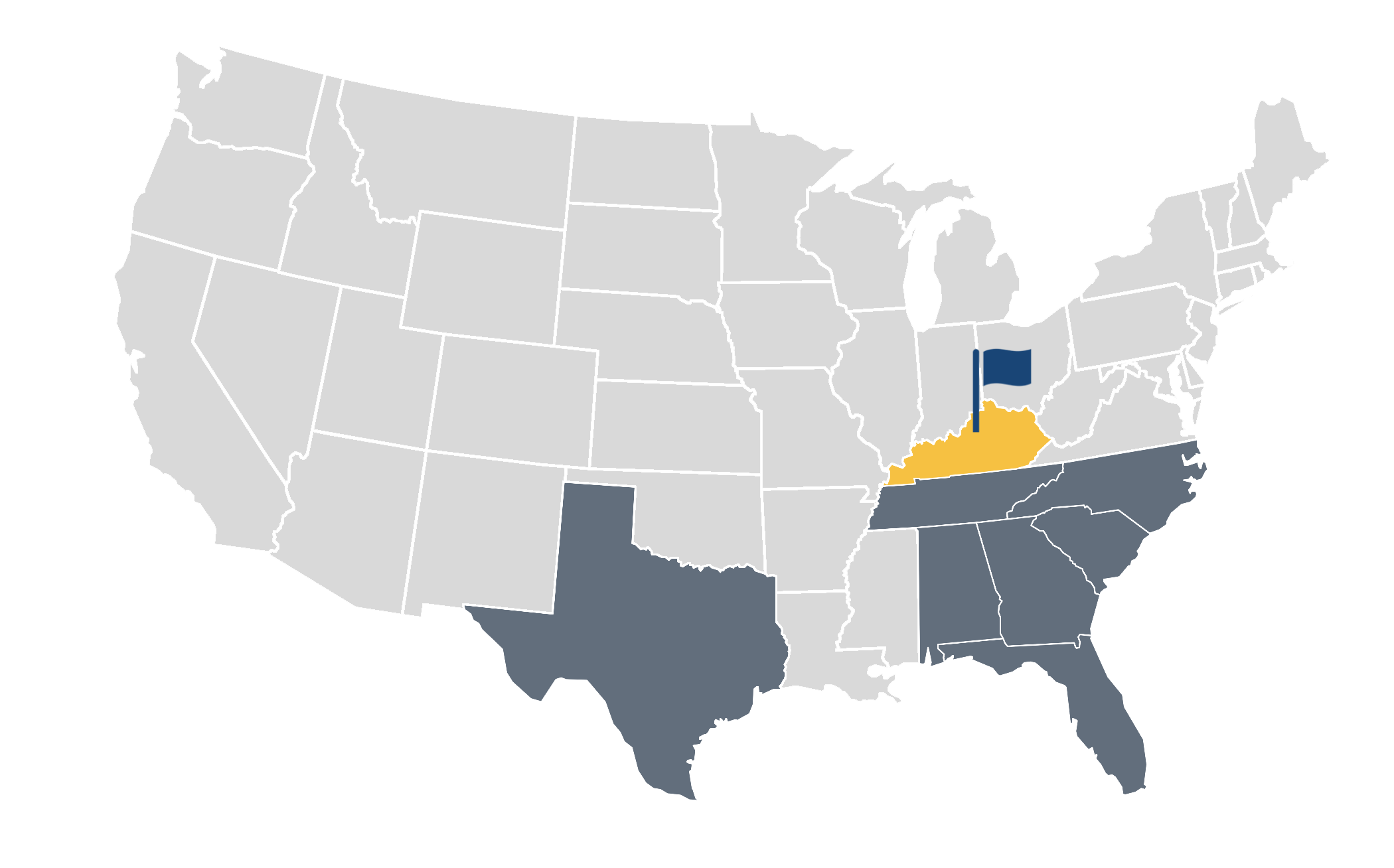

Platform Real Estate Group is a privately held industrial real estate development company headquartered in Louisville, KY, with offices in Louisville and Atlanta, GA.

We believe that industrial real estate is core infrastructure in the United States, and that the underlying fundamentals in the asset class are compelling. Absorption and demand are projected to accelerate over the next 10 years, specifically in high-growth regions such as the Southeastern U.S.

We founded Platform Real Estate Group in 2021 with a mission to develop and acquire a portfolio of best-in-class industrial facilities in the Southeastern United States. We view industrial real estate as more than commercial property, but as critical infrastructure assets necessary for the manufacture and distribution of products and provision of services through all phases of the supply chain. The tenants that we serve are the growth engines of the American economy, and we intend to enable the next generation of industry.

Accordingly, our strategy focuses on developing well-located, high-quality acquisition and development opportunities that can service multiple uses across the economic value chain. These infrastructure assets act as long-term value creators for end users, investors and the locations they serve.

Internally capitalized, allowing for patient execution and maximum value creation. We leverage local and national subject matter experts across all phases of the development and asset management processes.